Are you new to the Indian stock market? As a new trader, the large amount of data and the speed at which the market moves can feel overwhelming. You hear stories of people making money, but then you look at those complicated charts and hear confusing terms that make it all seem out of reach. It’s a common feeling, and you’re not alone. But what if you had a friendly guide, a smart helper who could simplify this journey for you, perhaps even a free AI tool for stock market India?

That’s exactly what Artificial Intelligence (AI) can be for you. Think of AI as a super-smart assistant that is rapidly becoming essential in stock market analysis. The best part? You don’t need to spend a lot of money to use it. Finding the right free AI tool for the Indian stock market can be the helping hand you need. These tools help you understand the confusion, point out interesting opportunities, and help you make smarter choices with your money, right from the very beginning.

What is AI in the Stock Market? A Simple Explanation

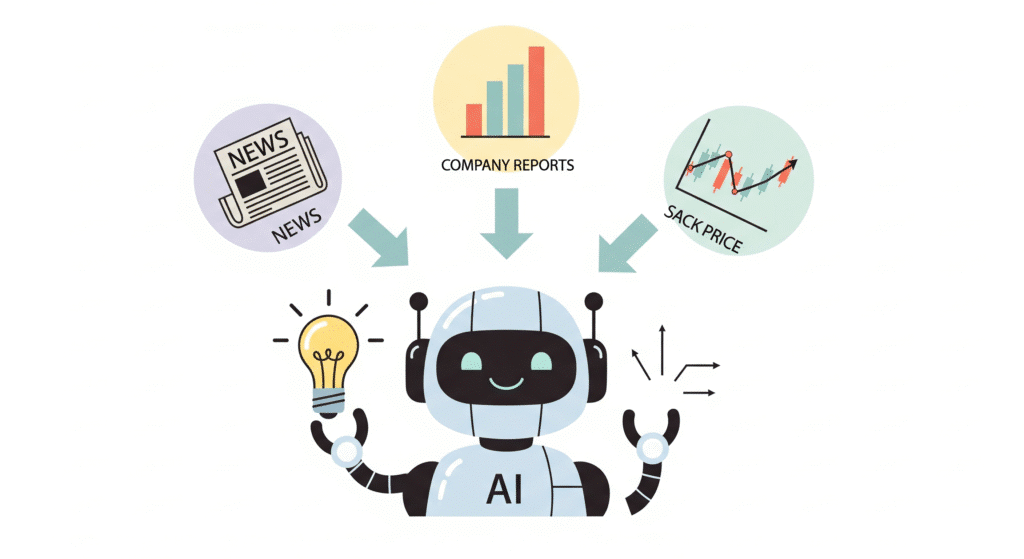

Let’s forget the complex definitions for a moment. Imagine AI is like a student who can read thousands of books in a minute. In the stock market, these “books” are different kinds of information:

- Price Charts: It looks at the history of a stock’s price—how it went up and down over many years.

- Company Reports: It reads the financial report cards of companies (like their balance sheets and profit statements) to check if they are healthy.

- News Articles: It scans news from all over the internet to see if people are saying good or bad things about a company.

- Market Data: It watches the daily activity on Indian stock exchanges like the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange).

The AI system, through a process called machine learning, learns continuously from all this data. Just like a student gets smarter with every book they read, the AI gets better at spotting patterns. It can identify small clues that suggest a stock might be about to rise or fall. For an average Indian investor, this means you get the benefit of a massive research team working for you, helping you understand the ‘why’ behind stock movements.

Why Use a Free AI Tool for the Stock Market in India?

You might wonder, ‘If these tools are so smart, why are they free?’ That’s a fair question. Here are the clear advantages for a beginner in India:

- It Costs You Nothing to Start: Financial advice can be expensive. Many expert advisors charge heavy fees. Free AI tools remove this cost barrier completely. You can start learning and experimenting with powerful technology without any financial pressure.

- Decisions Based on Facts, Not Feelings: We’ve all done it – bought something because it was going up, or sold it fast when it started falling. It’s easy to get emotional about money. AI doesn’t have emotions. It looks at pure data and gives you an unbiased view, helping you avoid common emotional mistakes. For example, instead of just saying “This stock looks good,” it might say, “This stock’s sales have grown by 20% every year for the past 5 years.”

- Saves a Ton of Time and Effort: There are over 5,000 companies listed on the Indian stock exchanges. Can you imagine trying to track all of them? It’s impossible. An AI tool can scan the entire market in seconds and show you a small list of stocks that match what you’re looking for. It automates the hard work for you.

- Designed for Everyday Traders: The creators of these tools know that not everyone is a finance expert – and that’s okay! That’s why many of them are built to be simple and easy to use. They present information with clean charts and simple language, making the stock market feel less intimidating.

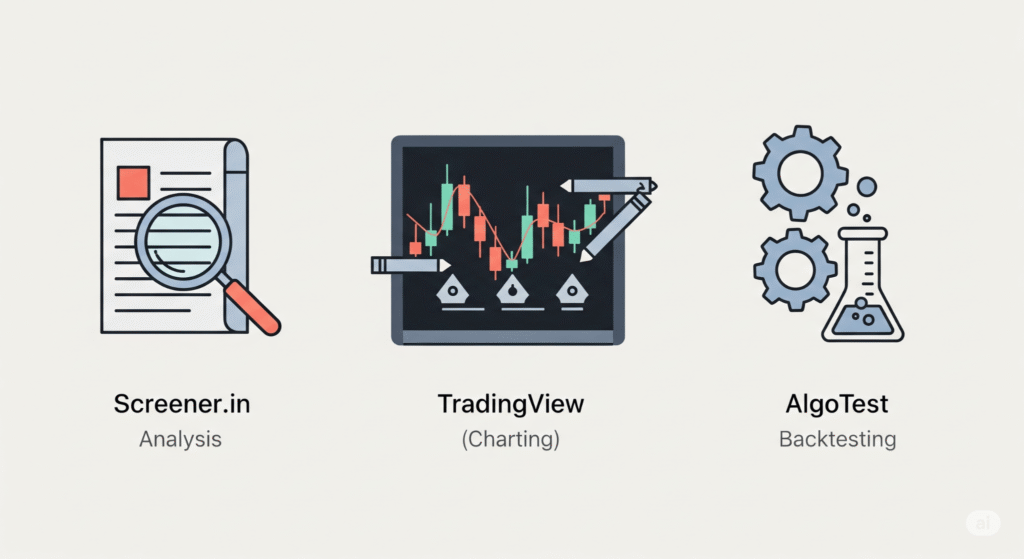

Top 3 Free AI Tools for the Indian Stock Market

Here’s a closer look at some of the best free tools that are perfect for someone starting in the Indian market:

1. Screener.in

- Best For: Identifying strong companies for long-term trading positions (Fundamental Analysis).

- What it does: Think of Screener as a giant, intelligent library of Indian companies. While it doesn’t predict the future, its AI-like power lies in how it sorts and presents financial data. You can access over ten years of financial reports, see a simple list of a company’s Pros and Cons, and compare it directly with its competitors. Its stock screening feature is incredibly powerful for fundamental analysis.

- Pros: It’s made specifically for India. The data is trustworthy and comes from official sources. The website is clean and very easy to navigate.

- Cons: It’s not great for looking at real-time price charts for day trading, as its focus is on longer-term investing.

- How to Get Started:

- Go to Screener.in.

- Use the search bar at the top to type the name of any Indian company (e.g., “Reliance Industries” or “Tata Motors”).

- You’ll immediately see a detailed page with its current price, market value, financial ratios, charts, and a simple list of pros and cons.

- Try the “Screens” tab to find companies based on your own ideas, like “Companies with low debt and high growth.”

2. TradingView (Free Plan)

- Best For: Visualizing price movements and executing technical analysis for short-term trades.

- What it does: TradingView is the gold standard for charting. It’s like having a professional artist’s toolkit for stock charts. The free version gives you access to beautiful, interactive charts for almost any stock in India. You can draw lines, add helpful indicators (like moving averages), and even practice trading with fake money (called paper trading).

- Pros: The charts are the best in the business. It’s a great way to learn how to read charts and spot trends. The paper trading feature is a safe way to practice.

- Cons: The free plan has ads, which can be a little annoying. You can only use up to three indicators on a chart at one time and set only one price alert.

- How to Get Started:

- Visit TradingView.com.

- In the search bar, type the name of an Indian stock, but add “.NS” for NSE stocks or “.BO” for BSE stocks (e.g., “INFY.NS” for Infosys on NSE).

- Click on “Full-featured chart” to open the main charting window.

- On the left side, you’ll see tools to draw trend lines. At the top, click on “Indicators” to add tools like “Moving Average Exponential” to your chart.

3. AlgoTest (Free Backtesting)

- Best For: Validating and refining your trading strategies without financial risk.

- What it does: Have you ever had a trading idea and wondered, ‘Would this have worked in the past?’ AlgoTest helps you answer that question. It lets you “backtest” your strategy. You tell the system your rules (e.g., ‘Buy this stock when its price crosses X, and sell when it crosses Y’), and it runs a simulation on past market data to show you if your idea would have made or lost money.

- Pros: It’s a fantastic way to test your ideas without risking real cash. You don’t need to know how to code. It’s very popular in India for testing strategies on Nifty and Bank Nifty options.

- Cons: It’s a specialized tool mainly for testing. It won’t give you stock ideas or company information. To trade your strategy live in the market, you’ll usually need a paid plan.

- How to Get Started:

- Go to AlgoTest.in.

- Sign up for a free account.

- Look for the backtesting section and choose the stock or index you want to test (e.g., Nifty 50).

- Use their simple interface to set your entry and exit conditions.

- Run the backtest and see the detailed performance report.

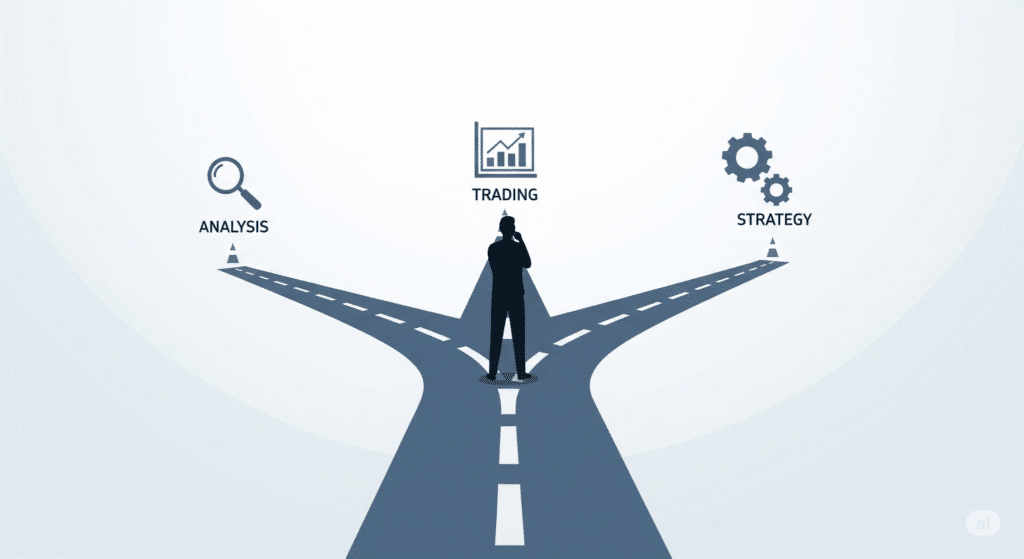

How to Choose the Right AI Tool for You

Don’t feel like you need to use all of them at once. The best tool for you depends on your personality and goals:

- If you are a “Patient Investor” who wants to buy good companies and hold them for years, start with Screener.in. Its deep fundamental data helps you make informed long-term trading decisions. Your focus is on the company’s health, and Screener is the best doctor for that.

- If you are a “Chart Watcher” who is fascinated by daily price movements and wants to make quicker trades, TradingView is your best friend. Its superior charting capabilities help you spot price trends, and TradingView is the best map.

- If you are a “System Builder” who likes to create rules and strategies and test them with data, AlgoTest will be the most exciting tool for you. It allows you to validate your trading system before risking capital.

As a beginner, the most important thing is for us that Pick one tool, play around with it, and get comfortable before moving to the next.

Final Tips & Very Important Warnings

These tools are amazing, but they are just tools. A great hammer doesn’t automatically make you a great carpenter, does it? Keep these points in mind:

- Don’t Follow AI Blindly: An AI tool might suggest a stock, but it’s your money on the line. Treat the AI’s suggestion as a starting point. Then, do your own homework. Read about what the company does, who its competitors are, and why the AI might have picked it.

- The Market is Unpredictable: No AI in the world can predict the future with 100% accuracy. The stock market can be affected by unexpected events. Always be prepared for the fact that you can lose money. That’s why it’s important to never invest money you can’t afford to lose.

- Garbage In, Garbage Out: An AI tool’s advice is only as good as the data it uses. The tools listed here use reliable data, but always be careful with unknown apps or websites that promise guaranteed returns.

- Start Small and Learn: When you first start, invest a very small amount. The goal of your first few investments should be to learn, not to get rich overnight – that takes time. Your knowledge, truly, is your biggest asset.

Conclusion

The Indian stock market is full of opportunities, and you no longer have to feel left out. Free AI tools have made it possible for anyone, regardless of their background, to access powerful information. Platforms like Screener.in, TradingView, and AlgoTest each offer a unique and valuable way to approach the market—whether you want to be a long-term investor, a chart analyst, or a strategy tester.

The key is to combine the intelligence of these tools with your own curiosity and judgment. Start with one tool, explore it without fear, and take that first confident step on your investment journey. You have a smart assistant ready to help.

As we’ve seen, the right AI tool can completely change how you approach the stock market, turning complex data into clear insights. But this is just one example of AI’s power. If you’re impressed by what AI can do for your investments, imagine what it could do for your daily work, creativity, and productivity. To explore further, we’ve put together a guide on other useful AI Tools that can help you with everything from writing to graphic design.

What are your thoughts on using AI for investing? Have you tried any of these tools? Share your experience in the comments below!

For more post visit my Blog Page.